Trade Finance solutions up to £5M in the UK

Empowering your global trade with fast decisions and a dedicated manager. Ideal for international trade financing, import/export management, and smooth cash flow. Includes integrated FX and international payments in 33 currencies.

Business advantages

We provide comprehensive trade finance solutions for exporters and importers. We help businesses overcome financial constraints to capitalise on new opportunities.

Better deals

Pay suppliers earlier to build trust and negotiate better terms.

Extended credit

Repay us up to 150 days after Aspire pays your suppliers.

Off-Balance sheet financing

Ensures your daily banking arrangements remain unaffected.

Flexible financing options

Customize your financing solutions to fit your business needs and growth plans.

Enhance your trade finance solution

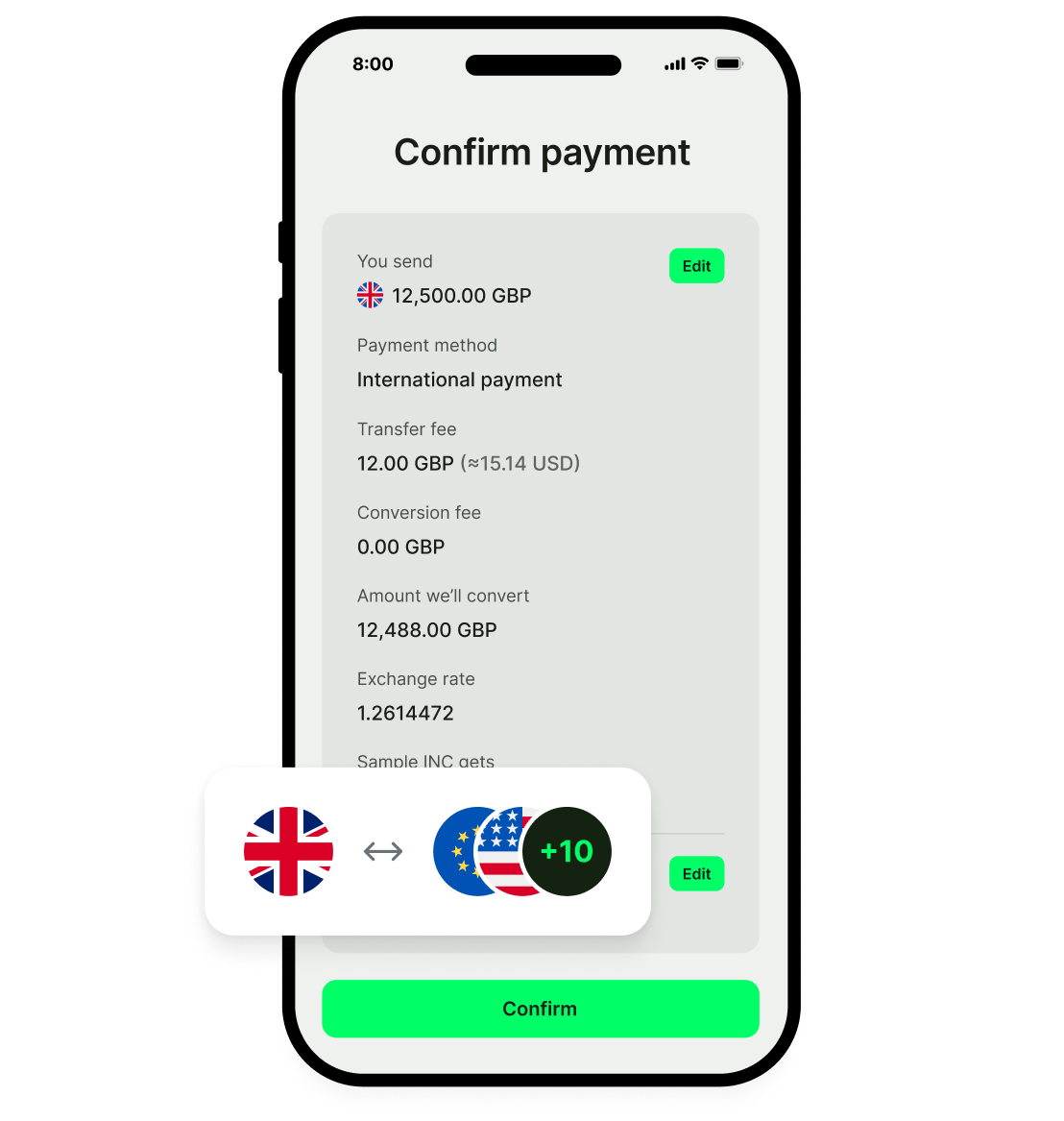

Muloot Money (our internal payments and FX solution) offers seamless international transactions with:

Support for most global currencies

Tailored solutions from our experienced team

Transparent fees with no hidden costs

Easy management of currency and payments

Licensed EMI, registered with the FCA

Common questions

Financial products can be complex, so we've listed some common questions you might have.

Trade finance serves as an important financial tool for businesses engaged in international trade, offering essential solutions to facilitate the smooth flow of goods across borders. Trade finance plays a pivotal role in providing financial assistance to businesses involved in importing and exporting goods from overseas. Essentially, trade finance is the practice of businesses borrowing money to facilitate the payment for importing and exporting goods.

Trade finance offers several benefits to businesses engaged in international trade, including:

Working Capital: Trade finance provides businesses with access to working capital, allowing them to finance their trade transactions without tying up their cash reserves.

Enhanced Liquidity: Trade finance facilities improve liquidity by providing businesses with the necessary funds to fulfil their trade obligations promptly, moving funds through the supply chain.

Global Market Access: Trade finance enables businesses to expand their reach into new markets by providing financial support for international trade transactions. This can help small businesses grow.

Yes, up to the maximum term as agreed between you and Aspire, which will be stipulated in your Trade Agreement.

No. Trade finance can also be used for local trade, which includes the buying and selling of goods.

Your supplier should be paid up to 2 working days after submission of your finance request.

The criteria are:

Based in the UK

Minimum 1 year trading

Basic details of the business

Annual turnover over £150,000

Bank statements from the last 12 months

Unlock potential.

Unleash progress.

Have a question about Aspire Lending?

We’re happy to help, please call us to speak to our support team.

+44 (0) 333 006 6901

Monday to Friday, 9:00 AM - 5:30 PM

contact@aspirelending.co.uk

We typically reply within a working day

Aspire Lending Limited is a company registered in England, under the company registration number 15534917. Its registered address is 24 Nicholas Street, Chester, England, CH1 2AU. Aspire Lending Limited is a subsidiary of Aspire Commerce Group Limited. Other subsidiaries include Aspire Payments Limited, trading as Muloot Money, which is registered with the Financial Conduct Authority under the Electronic Money Regulations 2011 for the issuing of electronic money, with Firm Reference Number 900883.

Copyright Aspire Lending Limited